One-stop compliance

solution for crypto business

The AML Check platform automates AML / KYC procedures and reduces compliance expenses

Check your Wallet

The AML Check platform automates AML / KYC procedures and reduces compliance expenses

Check your Wallet

INATBA

INATBA CDA

CDA ATII

ATII LSW3

LSW3

Amount of the risky funds detected

Compliance departments that accept our AML procedures

Service providers checked

We provide full pack of options for safe work with crypto

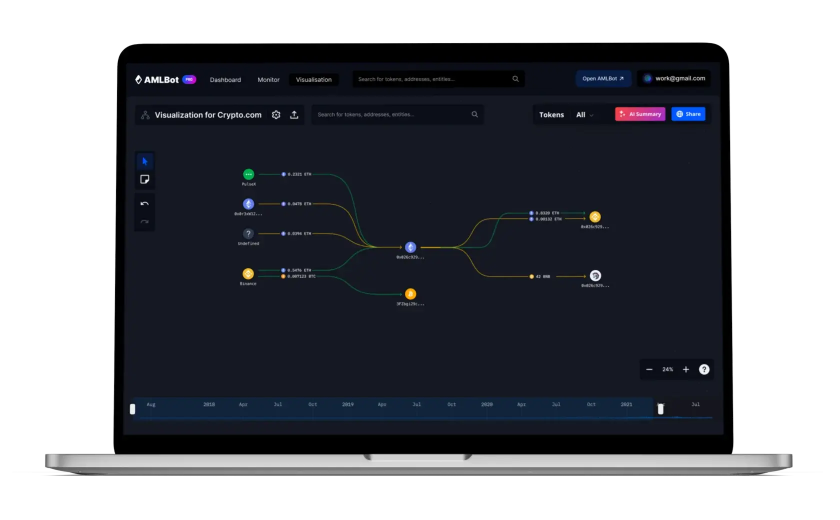

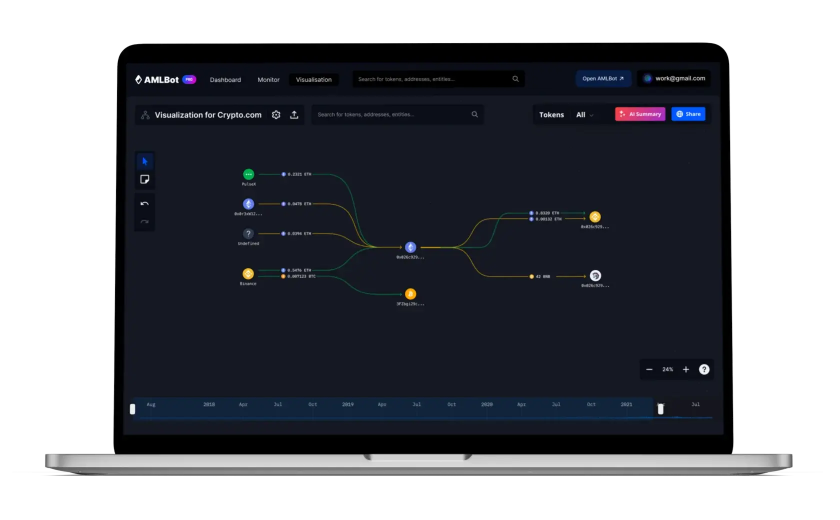

API solutions that empower AML compliance tools within your current system. All transactions are automatically verified to comply with AML and FATF requirements and reduce your business risk exposure.

Learn more →The streamlined and automated verification process empowers your business to swiftly onboard customers, reducing manual effort and mitigating identity fraud and illicit activity risks.

Learn more →Launch your crypto venture with ease, simplicity, and confidence through our streamlined AML and KYC consulting, ensuring smooth compliance and effective risk management right from the beginning.

Learn more →Streamline corporate account opening on CEX EMI with our expert assistance, ensuring your focus remains on business growth in the crypto industry.

Learn more →Recover stolen cryptocurrencies with AML Check expert blockchain investigations, swiftly identifying culprits and tracing funds for effective recovery.

Learn more →Per our data, one in four wallets is suspicious.

Spending a few dollars on a check may save you a large sum.

AMLBot offers a wide range of compliance solutions customized for each client. We're confident in meeting your demands after helping 300+ crypto enterprises of all sizes in 25 jurisdictions.

AMLBot understands the significance of fast, friendly customer support, thus we're always here for our clients. 24/7 support.

Contact →Contact us via messenger. We are in touch 24/7, are always ready to answer quickly, and are in the chat now.

Write a message →The overall risk percentage is the probability that the address is associated with illegal activity. The sources of this risk are the known types of services with which the address has interacted and the percentage of funds accepted from / given to these services for which the overall risk is calculated.

AMLBot checks the specified wallet address for connections to known blockchain services. AMLBot conventionally groups these services into groups with different levels of risk of illegal activity. The check shows the connections of the checked address to these groups as a percentage. Based on all the links, an average risk score is given, which helps the user to make further decisions about the assets.

Each client determines for himself what percentage of risk is acceptable for him. Conventionally, the risk score can be divided as follows: - 0-25% is a clean wallet/transaction; - 25-75% is the average level of risk; - 75%+ such a wallet/transaction is considered risky. It is also worth paying attention to the red sources of risk in the detailed analysis, described in page.

After transaction confirmation, the balance is replenished: - up to 10 minutes if payment was made within 24 hours after the invoice was issued, - up to 25 minutes if payment was made after 24 hours after the invoice issuance. Overall, BTC, ETH, USDT, and fiat are processed faster than other coins.

AMLBot finds links of a verified address to different users in the blockchain, each with a different conditional risk score. The overall risk score is the average of all the components found. For example, if out of 2 BTC on the wallet being checked, 1 BTC came from mining (0% risk) and another 1 BTC from Darknet (100% risk), the risk score would be 50%.

By checking counterparties' wallets before a transaction, you can reject their assets if the risk score is high. Also, before transferring funds to other services, you can check your wallet address and save the result (make a screenshot). If the check shows that your assets had no connection with illegal activity and the service blocked you, you can provide the saved result to confirm the purity of your assets.

The verification results are based on international databases, which are constantly updated. So an address that had 0% risk yesterday may have received or given the asset to a risky counterparty today. In this case, the risk score will change. If you want to be sure of the result and determine what the cause of the high risk is, we can do a detailed check for you. To do so, email us at [email protected].

An address (wallet) check involves analyzing every address ever associated with it, including addresses from which funds were received and to which funds were sent. When you perform a transaction check (by specifying a TxID), choose one of the following: - If you received the funds (Recipient) and specify the deposit address, the analysis will review the addresses from which the funds originated. On a blockchain explorer, these are the addresses on the left, along with everyone they interacted with prior to the transaction. - If you sent the funds (Sender) and specify the withdrawal address, the analysis will examine the wallet that received the funds (displayed on the right in the blockchain explorer), as well as all of its associated connections prior to this transaction. Thus, when checking a TxID, choosing "receiving funds" will assess the risks for the recipient, while choosing "sending funds" will evaluate risks for the sender.

They stay within your account, and you can use them at any time.

An answer to this depends on your unique risk model. The general recommendation would be to perform an AML check every time you interact with an unknown wallet or a smart contract.

AMLBot supports all major blockchains and tokens on them. We are constantly adding support for additional cryptocurrencies. You can always check the up-to-date list of supported cryptocurrencies in web dashboard or in API Documentation.

You can buy additional checks as needed. The number of checks is always displayed within your user information.